EALLIANCE GROUP: From POC to

Production Platform

Building a cross-border fintech platform that combines traditional banking rails with blockchain technology to enable fast, compliant transfers between Europe and West Africa.

As CTPO, Michaël built our entire blockchain platform from the ground up... delivering complex technology that our users find simple. He balanced strict European compliance with African market realities. I recommend him without reservation.

A Broken Remittance Market

In 2017, sending money from Europe to Africa was expensive, slow, and opaque. Traditional remittance services charged 7-12% fees, transfers took 3-5 business days, and recipients often needed bank accounts in regions where banking penetration was below 20%.

eAlliance's vision was ambitious: combine traditional banking rails (SEPA, Faster Payments) with blockchain settlement to create a faster, cheaper, more transparent alternative. But they needed someone who could actually build it — not just architect it on paper.

The challenge wasn't just technical. It was navigating multi-jurisdiction compliance (UK, France, 6+ African nations), building a cash-out agent network in regions with unreliable connectivity, and creating both a custom blockchain (AJO) and euro-backed stablecoin (EAJO) that regulators would accept.

7-12% fees

Traditional remittance costs

3-5 days

Transfer time to recipient

Hidden fees

Poor exchange rate transparency

Low banking access

<20% penetration in target regions

What We Delivered

Regulatory Compliance

Operating under UK and French financial regulations with automated KYC/AML, sanctions screening, and full audit trail.

Market Penetration

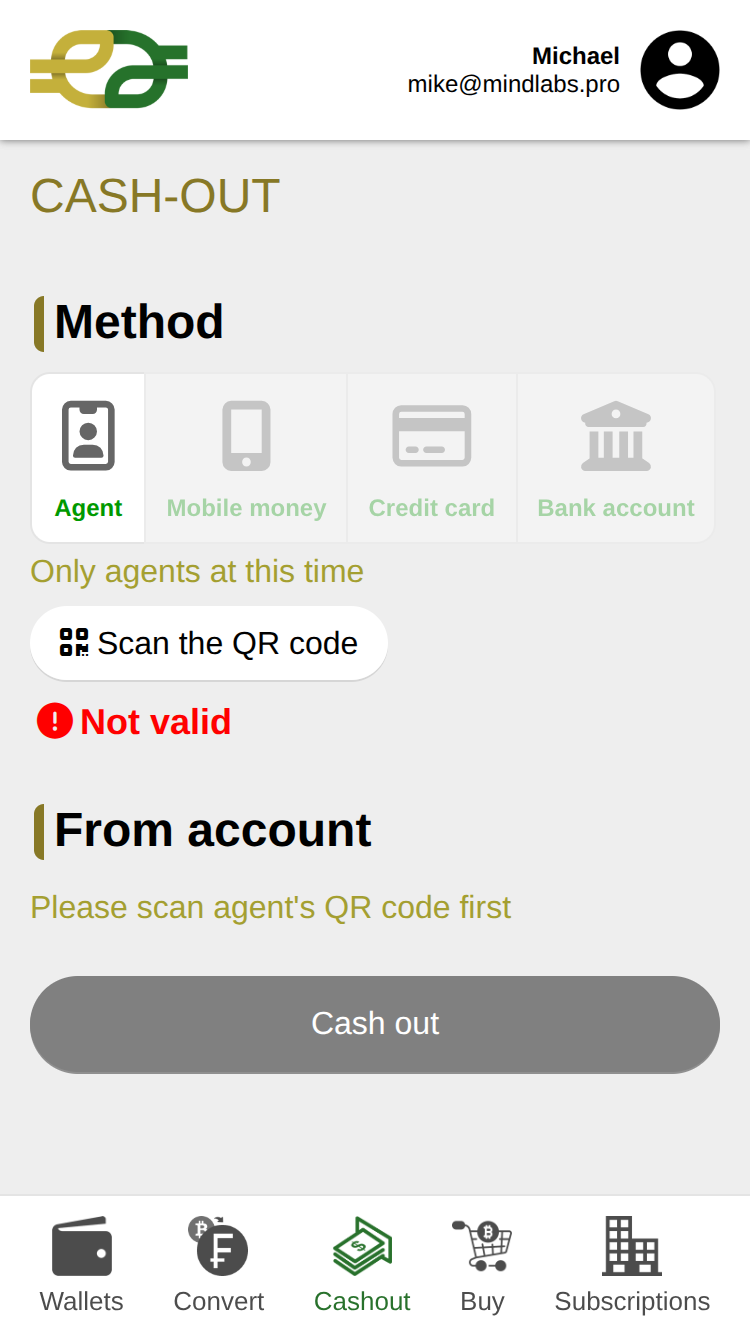

Leveraged existing mobile money and agent networks in West Africa — shortening time-to-market by avoiding infrastructure buildout.

Multi-Rail Payments

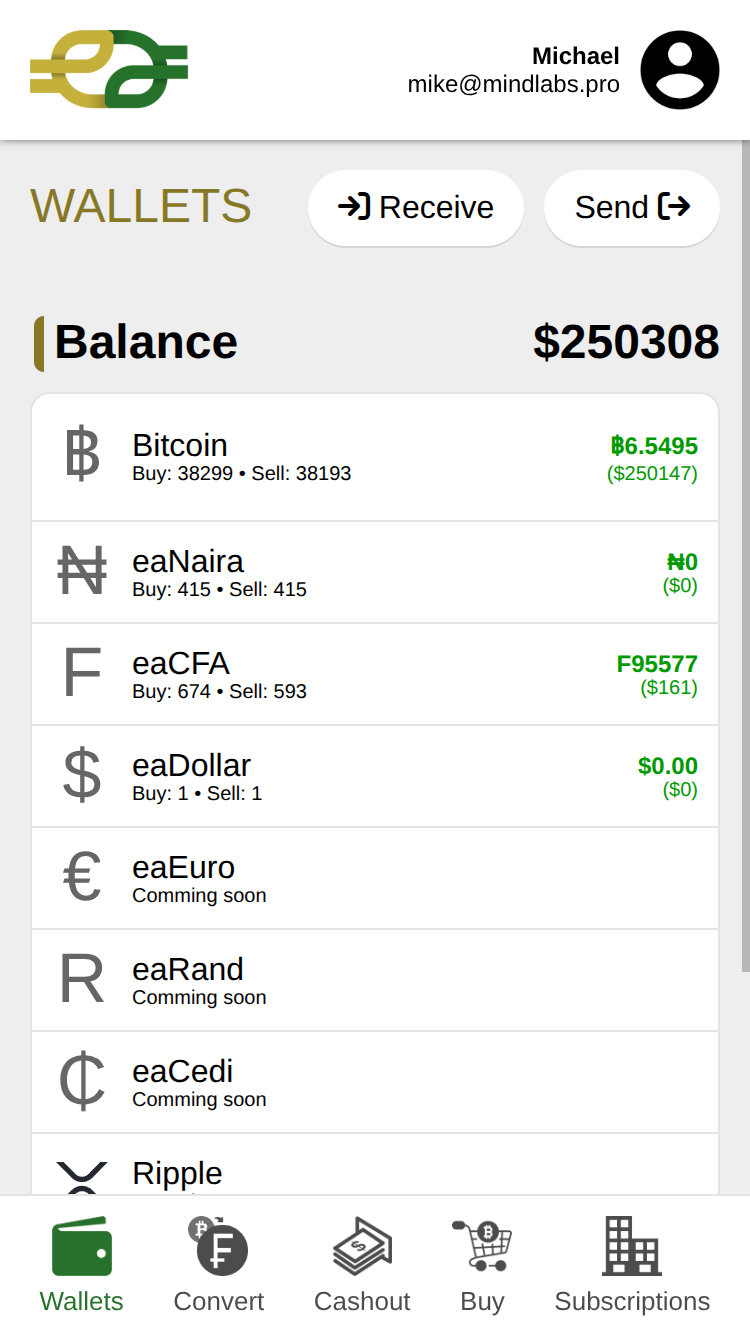

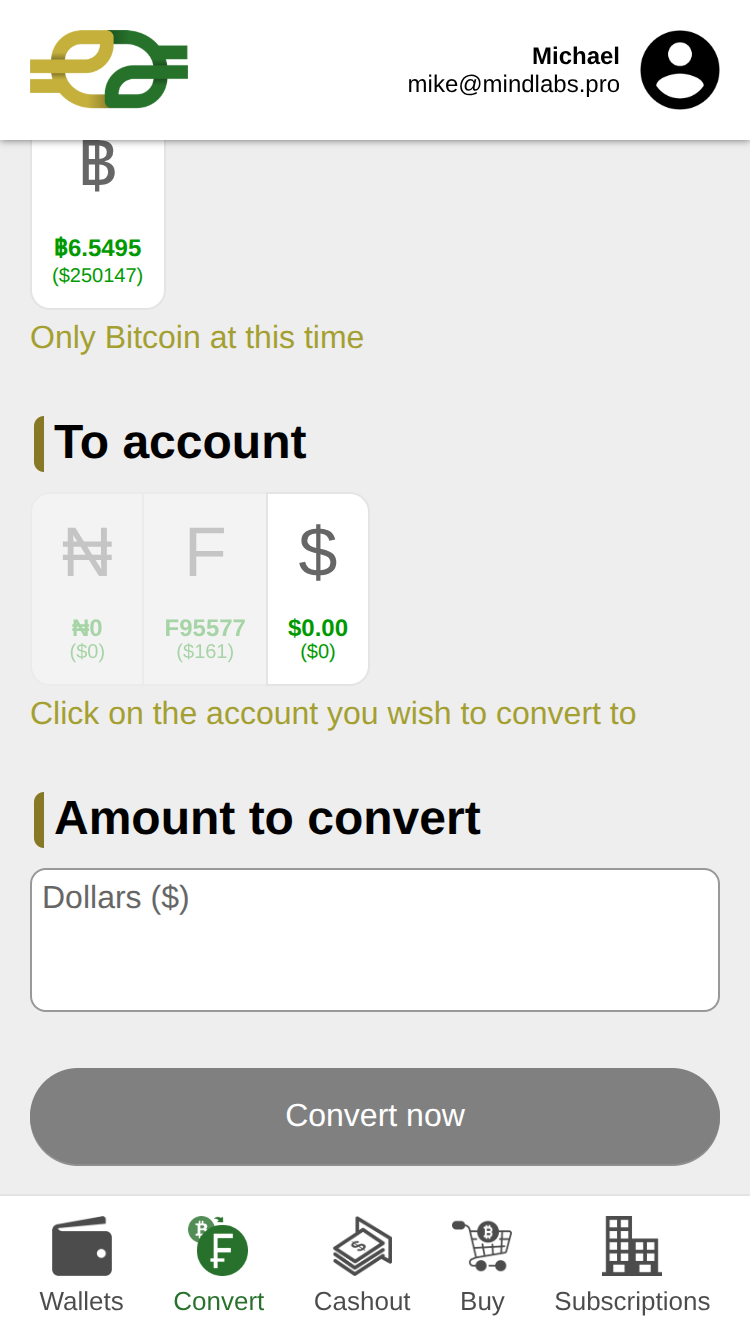

UK Faster Payments, SEPA, card payments, and crypto — unified into a single platform with consistent user experience.

Workforce Development

Built training platform and programs creating skilled fintech jobs in target markets — supporting local economies.

How We Got There

This wasn't a 6-month agency project. It was a 6-year evolution — iterating based on real user feedback and regulatory requirements. Here's the technical deep dive.

The Architecture

A multi-rail payment infrastructure combining traditional banking with blockchain settlement

Sender (UK/France)

Platform

Recipient (Africa)

Fiat Gateway

UK Faster Payments, SEPA Instant, SEPA Standard, Open Banking integration, Card payments

Crypto Custody

Institutional-grade MPC wallet infrastructure. HSM integration. Hot/Warm/Cold wallet segregation.

AJO Blockchain & EAJO

Custom Bitcoin-fork blockchain created by EALLIANCE with EAJO euro-backed stablecoin. Full control over fees, throughput, and compliance hooks. 1:1 EUR backing with monthly proof of reserves.

Payout Engine

Leveraged existing mobile money and agent networks to accelerate market penetration without building cash-out infrastructure from scratch.

Compliance Engine

Automated KYC/KYB, blockchain analytics, sanctions screening, real-time transaction monitoring. Operating under UK and French financial regulations.

Ledger System

Double-entry accounting with full audit trail. Immutable transaction history. Automated regulatory reporting.

The Stack (Scaled Architecture)

What we shipped in production after 6 years of evolution

Frontend & Mobile

Chose PWA over native apps for maximum accessibility — no app store required, works on any device, functions offline in low-connectivity areas.

Backend

Database & Cache

Infrastructure

Security & Compliance

Blockchain

Built custom blockchain for full control over transaction fees, throughput, and built-in compliance hooks.

From POC to Production

This wasn't a 6-month agency project. It was a 6-year evolution — iterating based on real user feedback and regulatory requirements.

Validate the core technology

Basic platform with user registration, document-based KYC, crypto wallets (BTC, ETH), EAJO transfers, and manual fiat processing. Single-region deployment.

Regulatory compliance and automated operations

Integrated automated KYC with liveness detection, direct banking APIs (UK Faster Payments, SEPA), mobile money payouts leveraging existing networks in 4 countries.

Enterprise-grade infrastructure and workforce development

Full microservices architecture, multi-region deployment, PWA for maximum accessibility (no app store barriers), partner API, workforce training platform. Growth constrained by challenging financial and political environment in target markets.

Note: Adoption growth has been constrained by challenging financial and political conditions in target West African markets. The platform remains operational and continues to serve users across 4 countries.

The Hard Parts

Not the sanitized version. Here's what actually made this difficult — and how we solved it.

Multi-Jurisdiction Compliance

Operating under UK FCA, French ACPR, and varying African regulatory frameworks simultaneously. Each jurisdiction has different KYC requirements, reporting obligations, and licensing structures.

Solution: Built a flexible compliance engine with jurisdiction-specific rule sets. Tiered verification based on transaction limits. Early engagement with regulators before building — not after.

Unreliable Connectivity in Africa

Cash-out agents often work in areas with 2G connectivity, frequent network drops, and power outages. Standard web/mobile apps fail in these conditions.

Solution: Chose PWA over native apps — no app store downloads required, works on any device with a browser, offline-first with local queuing. SMS fallbacks for critical notifications. Spent time in the field understanding real agent workflows before writing code.

Building a Custom Blockchain & Stablecoin

Creating both a custom blockchain (AJO, a Bitcoin fork) and euro-backed stablecoin (EAJO) that regulators would accept — before stablecoins were well understood. Needed full control over infrastructure plus proof of 1:1 backing and auditability.

Solution: Built AJO blockchain from Bitcoin fork for control over fees, throughput, and compliance hooks. Monthly proof-of-reserves published. Full reserve backing in regulated European banks. Transparent mint/burn mechanics on-chain. Educated regulators on the technology before seeking approval.

Fraud Prevention Without Blocking Legitimate Users

Cross-border transfers are high-risk for fraud. But aggressive fraud prevention blocks legitimate users — especially in regions where identity documentation is inconsistent.

Solution: Multi-layered approach: device fingerprinting, behavioral analytics, blockchain tracing, manual review queue for edge cases. Tiered limits that increase with trust score. False positive rate dropped from 12% to under 2%.

What I Learned

" The biggest challenge wasn't technical — it was understanding the real-world workflows of cash agents in markets where smartphone penetration and internet connectivity vary dramatically. We spent significant time in the field understanding how agents actually work before writing a single line of code. This user research made the difference between a platform that looked good in demos and one that actually works in Dakar, Lagos, and Abidjan. "

Building Something in Fintech?

Whether it's payments, crypto, compliance, or cross-border operations — I've shipped production systems that handle real money. Let's talk about your project.

Let's Talk About Your ProjectLet's Build Something That Ships

Free 30-minute strategy call. No pitch deck. No sales pressure. Just an honest conversation about your project.

Trusted by startups, scale-ups, and enterprises across France and internationally.